Happy to help you

Customer care 99610 33333

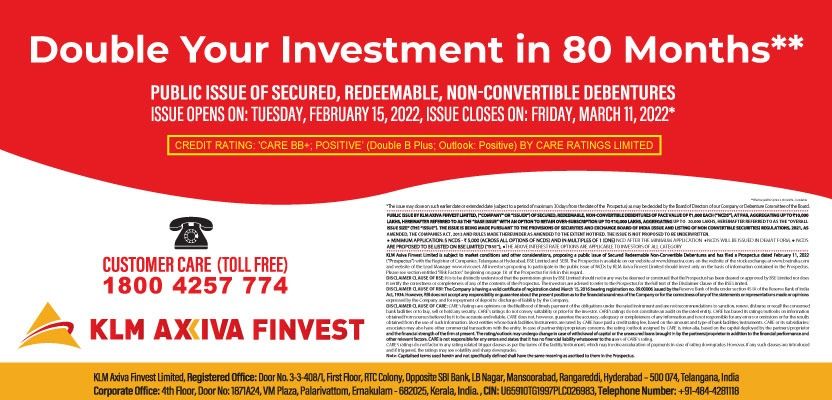

Toll free 1800 4257 774

Today's Gold Rate: ₹6,487.00/gram

How Gold Loans Can Help in Emergency Situations ?

Dec 4, 2023

In times of unexpected financial crises, having a reliable and quick solution can be a game-changer. Gold loans can play a crucial role in providing financial assistance during emergency situations. Gold is generally considered a stable and valuable asset

In times of unexpected financial crises, having a reliable and quick solution can be a game-changer. Gold loans can play a crucial role in providing financial assistance during emergency situations. Gold is generally considered a stable and valuable asset. It provides a way to unlock the liquidity of an asset (gold) without the need to sell it. This is especially beneficial when the borrower doesn't want to part with the gold permanently but needs funds for an emergency period.

Borrowers have the flexibility to use the funds from a gold loan for various purposes, including medical emergencies, education expenses, home repairs, wedding costs, unexpected travel, or any other urgent financial need. Gold loans generally have a high loan-to-value (LTV) ratio, meaning borrowers can secure a significant amount of money relative to the value of their gold assets. The evaluation of gold and disbursal of the loan are generally quicker compared to other forms of loans, making it an ideal choice in emergencies where time is of the essence.

This article explores the significance of gold loans in emergency situations and how they can provide a financial safety net.

In what situation can gold loans help us?

Following are the main situations in which a gold loan can become handy:

-

Business Emergencies

A gold loan can offer quick access to funds, allowing the business owner to address immediate financial needs. The streamlined process ensures timely disbursal, helping to navigate the cash flow gap during an emergency. For instance, a retail business experiences a sudden dip in sales, leading to a cash flow crisis. With monthly operational expenses looming, the business owner uses a gold loan from a microfinance company like KLM Axiva to bridge the gap. The quick disbursal of funds helps the business meet its immediate financial obligations and navigate through the challenging period until sales pick up. Gold loans are instrumental in addressing business emergencies and providing quick and flexible financial support.

-

Educational Expenses

Educational expenses, such as tuition fees, textbooks, or sudden enrollment costs, often require immediate financial attention. Gold loans provide a swift solution, as the evaluation of gold assets and the disbursal of funds are typically quicker compared to the lengthy processing times associated with traditional unsecured loans. Unlike traditional unsecured loans, which often require proof of income, gold loans are secured by the collateral (gold) itself. This makes it accessible to individuals, including students or those with irregular income, who may find it challenging to provide traditional income documentation. The secured nature of gold loans reduces the risk for lenders, often resulting in lower interest rates compared to unsecured loans. Gold loans typically offer flexible repayment options, allowing borrowers to choose a repayment plan that aligns with their financial capabilities and the expected timeline of their education. This flexibility helps in better managing the loan while pursuing educational goals.

-

Medical Emergencies

Health crises demand immediate attention, and so do the associated expenses. Gold loans stand out for their quick disbursal of funds and high loan-to-value ratio, ensuring that you have the financial support required during critical medical situations. The high loan-to-value ratio in gold loans allows borrowers to secure a significant amount of funds relative to the value of their gold assets. This is particularly beneficial in medical emergencies where substantial amounts may be needed for hospital bills, treatments, or surgeries. Understanding how gold loans can be a lifeline in such scenarios is essential for preparedness.

-

Wedding Expenses

Planning a wedding can be financially demanding, and a gold loan provides a way to manage the costs without causing undue stress on one's savings or current financial situation. Gold loans typically offer flexible repayment options. Borrowers can choose from various tenures based on their financial capabilities and preferences. This flexibility allows individuals to customize their repayment plans, aligning them with their income flow and ensuring that the loan doesn't become a financial burden. Lenders may offer various gold loan products with different features, interest rates, and repayment terms. This variety allows borrowers to choose the loan product that best meets their needs, ensuring that the financial solution aligns with the specific requirements of wedding expenses.

-

Unexpected Travel

Whether for business or personal reasons, unexpected travel can be financially draining. Gold loans simplify the process with their easy application and approval procedures. It typically involves a straightforward application process with minimal documentation. This simplicity is advantageous, especially during situations that require quick financial decisions, such as unexpected travel. The reduced paperwork streamlines the application process, making it more accessible and less time-consuming. The evaluation of gold assets is typically quicker than the comprehensive credit checks associated with unsecured loans. This allows for a faster approval process, making gold loans an ideal choice for those who need swift financial assistance for unexpected travel.

Also read: Why Gold Loans Are a Better Option Than Selling Your Gold

In times of crisis or urgent financial need, considering gold loans is a prudent choice. The quick disbursal of funds, high loan-to-value ratio, asset security, flexibility in repayment options, and ease of application and approval process make gold loans a practical and efficient option for individuals facing unexpected situations.

Empower your financial preparedness by considering gold loans during emergencies. Explore the reliable gold loan options available with KLM Axiva, a trusted partner in securing your financial well-being. KLM Axiva offers gold loans at lower interest rates with flexible repayment options. Don't wait for a crisis to strike—take proactive steps to safeguard your financial future today.